Getting a keen FHA Financing: Washington State Publication

A national Homes Management financing, commonly titled an FHA loan, the most prominent financial options today. The latest Company regarding Casing and you may Urban Development (HUD) manages this type of loans, that have been enabling lower-earnings and you will brand new homeowners due to the fact 1930s. The federal government secures FHA funds, and you can a bank and other department-acknowledged lender affairs all of them.

Over the past 10 years, more than 275,000 parents inside Washington used FHA money to shop for their residential property. In this article, we shall talk about the huge benefits and needs regarding FHA money into the Washington Condition.

FHA Mortgage: Washington State Professionals

FHA finance render a great opportunity for those in Arizona County having a go from the possessing their unique family, especially if they won’t meet with the stricter guidelines from conventional loanspared to other conventional money, needed reduce costs to your modestly listed belongings and have much more flexible standards for applicants.

- Lower credit rating criteria

- Interest levels which might be lower than traditional mortgage rates

- Gift financing greeting

- Cosigners desired

- Highest obligations-to-money (DTI) ratio acceptance

FHA Loan Criteria

FHA funds are very appealing to the fresh homebuyers and lower-income parents because of their flexible financing standards. So you’re able to qualify for an enthusiastic FHA financing, you ought to meet the pursuing the stipulations.

Credit history

To be eligible for the lower advance payment regarding a keen FHA mortgage, your credit score must meet or exceed 580. In contrast, antique finance want a rating of at least 620.

Downpayment

Off costs having FHA funds are the same in just about any condition. Minimal installment loan Nebraska advance payment demands try 3.5% of cost. Yet not, credit ratings below 580 might need off payments out-of upwards so you can 10% of your own complete home price.

DTI Ratio

So you’re able to assess the proportion, make sense your monthly payments (as well as lease or domestic payment). Up coming, split the complete by your monthly earnings prior to fees. The result is your DTI proportion, that is in the form of a share.

In terms of FHA loans are concerned, you should not has a good DTI proportion more than 43%. However, particular compensating situations (such as profit offers, longer work background or sophisticated credit) helps you get approved which have large personal debt profile.

Mortgage Insurance coverage

You to significant need for FHA fund is mortgage insurance coverage. Regardless of bank, the FHA finance wanted right up-front home loan premium and you will fundamental home loan top. This type of insurance rates sizes setting similarly to individual home loan insurance coverage (PMI) to possess antique funds and you may manage the lending company for individuals who give it up and then make regular costs in some way.

File Standards

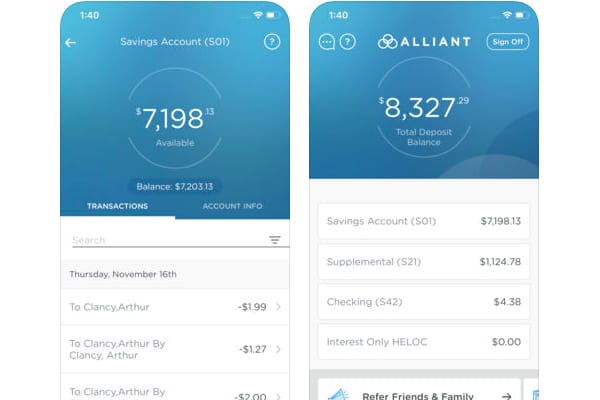

In terms of files, you need to greeting delivering most recent proof earnings and you can proof of a job over the past a couple of years when it comes to pay stubs, financial statements and you may tax statements.

House Standards

In order to be eligible for an enthusiastic FHA financing, you should adhere to particular residence conditions. These suggest that the home you need to get is meant as the majority of your house. You can’t explore FHA finance for trips homes or other secondary financial support properties.

FHA Financing Limitations to possess Washington State

For each nation’s FHA mortgage limits are very different, and some actually disagree certainly counties. New restrictions confidence the kind of possessions you have in mind while the mediocre home transformation worth of the area the spot where the property is located. The mortgage limitations having an individual-nearest and dearest household when you look at the Arizona initiate at the $420,860 within the rural counties and you will go up in order to $891,250 from the Seattle urban urban area.

Contact Seattle Home loan Coordinators Today!

If you are interested in studying more and more FHA funds for the Arizona otherwise need certainly to mention your absolute best route to own refinancing their current mortgage, Seattle Home loan Coordinators will help. After you reach out to Seattle Home loan Planners, you will have a group of educated gurus to review and you can speak about your options. Therefore, what are you awaiting?